what state has the highest capital gains tax

52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains. The 10 states with the highest capital gains tax are as follows.

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

If youre looking for a country with lower tax rates look no further than Estonia.

. The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax on the sale or exchange of long-term capital assets such as stocks bonds business interests or other investments and tangible assets. The capital gains tax on most net gains is no more than 15 for most people. Transfer tax at 2 on transfers of Jamaican real estate and securities.

At the other end of the spectrum California has the highest capital gains tax. He United States has one of the highest capital gains taxes in the world. The lowest rate of 25 percent is shared among the nine states with no personal income tax Alaska Florida Nevada New Hampshire South Dakota Tennessee.

Then it was hit with a lawsuit to strike it down as unconstitutional before Governor Inslee could even sign the legislation into law. And this is a decrease from what it once was. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

75 until Proposition 30 expired. Gains arising from sale of stock are taxed at a total rate of 20315 15315 for national tax purposes and 5 local tax. If their income ranges from 40401 to 445850 they will pay 15 percent on capital gains.

Denmark has the worlds highest capital gains tax rates with a top rate of 42 on earnings over about 9000. States With the Highest Capital Gains Tax Rates. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

5 US States and Countries with the Highest Capital Gains Taxes 1. Japan Last reviewed 02 March 2022 Capital gains are subject to the normal CIT rate. The state with the highest top marginal capital gains tax rate is California 33 percent followed by New York 315 percent Oregon 31 percent and Minnesota 309 percent.

Californias state-level sales tax rate remains the highest in the nation at 725 as of 2021. Short-term capital gains are taxed at the investors ordinary income tax rate and are defined as investments held for a year or less before being sold. Breaking this down further the states with the highest top marginal capital gains tax rates are California 33 percent New York 316 percent Oregon 312 percent and Minnesota 309 percent.

16 hours agoAs I previously reported the Washington state capital gains tax has had a turbulent ride commencing with a rough ride through the legislative process where it almost hit disastrous terrain on at least six 6 occasions. The Washington State Capital Gains Tax May Have More Than Nine Lives The Saga Continues With the State Attorney General Appealing to the Highest State Court By Larry Brant on 41222 Posted in Legislation State and Local Tax Tax Laws. California taxes capital gains as.

Combined with local sales taxes the rate can reach as high as 1025 in some California cities although the average is 868 as of 2021. The state with the highest top marginal capital gains tax rate is California 33 percent followed by New York 315 percent Oregon 31 percent and Minnesota 309 percent. The Washington State Capital Gains Tax May Have More Than Nine Lives The Saga Continues With the State AG Appealing to the Highest State Court.

The states with the highest top marginal capital gains tax rates. A 20 percent tax rate is charged when a person earns above that income. As of 2021 the long-term capital gains tax is typically either 0 15 or 20 depending upon your tax bracket.

9 rows While most states tax income from investments and income from work at the same rate nine. If your taxable income is less than 80000 some or all of your net gain may even be taxed at 0. Federal income tax on the net total of all their capital gainsThe tax rate depends on both the investors tax bracket and the amount of time the investment was held.

In the United States of America individuals and corporations pay US. Capital gains tax on taxable income over 40400 dollars wont apply to individuals in 2021. Subscribe to receive email or SMStext notifications about the Capital Gains tax.

Capital gains tax rates on most assets held for a year or less correspond to. Short-term capital gains are taxed at the same rate as federal income taxes which can be up to 37 while the highest long-term capital gains. Its a whopping 39 on long-term capital gains and 20 on short-term capital gains.

The Estonian government only charges 24 to those who are lucky enough to live there. The nine states with no personal income tax Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming have the lowest rate in the United.

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

9 Expat Friendly Countries With No Capital Gains Taxes

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax Capital Gain Integrity

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Can Capital Gains Push Me Into A Higher Tax Bracket

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How Capital Gains Affect Your Taxes H R Block

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Capital Gains Tax Rates By State Nas Investment Solutions

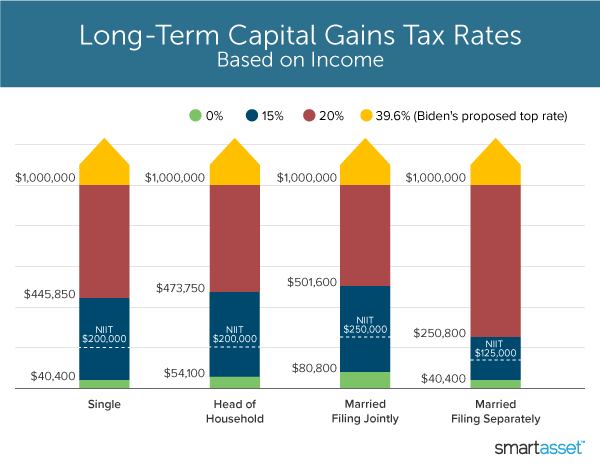

What S In Biden S Capital Gains Tax Plan Smartasset

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)